The Chinese market experienced considerable volatility in July and August. The market first took a leg down as the Chinese economy showed signs of weakness when the government continued its deleveraging efforts. The market was expecting some sort of support by the government but was worried whether it would come too late or at all. Then on July 23rd, at the State Council’s executive meeting chaired by Premier Li Keqiang, the government gave a clear indication that it is looking to better utilize its fiscal and monetary policies to support domestic demand, boost the development of the real economy, and make sure the economy performs within a reasonable range amid external uncertainties. Afterwards, roughly 1 week later on July 31st, President Xi Jinping chaired the Politburo meeting which stressed on more proactive fiscal policies, steady monetary policy versus the previous tone of “steady and neutral monetary policy”, supply-side reforms, and accelerating infrastructure fixed-asset investment. The government indicated that they would support the economy when needed and take concrete actions. But the markets did not experience a prolonged recovery and instead took another leg down when poor economic figures were released in August.

So far this year, the measures implemented include three Reserve Requirement Ratio (RRR) cuts, expansion of the collateral accepted for Medium-term Lending Facility (MLF), and increase in foreign exchange risk reserve ratio of forward sales from 0% to 20%1 . Furthermore, the release of implementation details of the new asset management rules in July was a marginal relaxation from the government’s guidance in April which gave a relief to the market. The market recovered towards the end of the month on the back of these slightly more encouraging developments. However, risk appetite currently is still quite weak on the back of the escalating trade tension with the US. Furthermore, the sudden deterioration of the eruption of a typical emerging market crisis in Turkey has significantly raised investors’ risk alertness. The market is also concerned about whether the government’s stimulus will be effectively implemented, or whether it would need a significant time period before it proves to be effective.

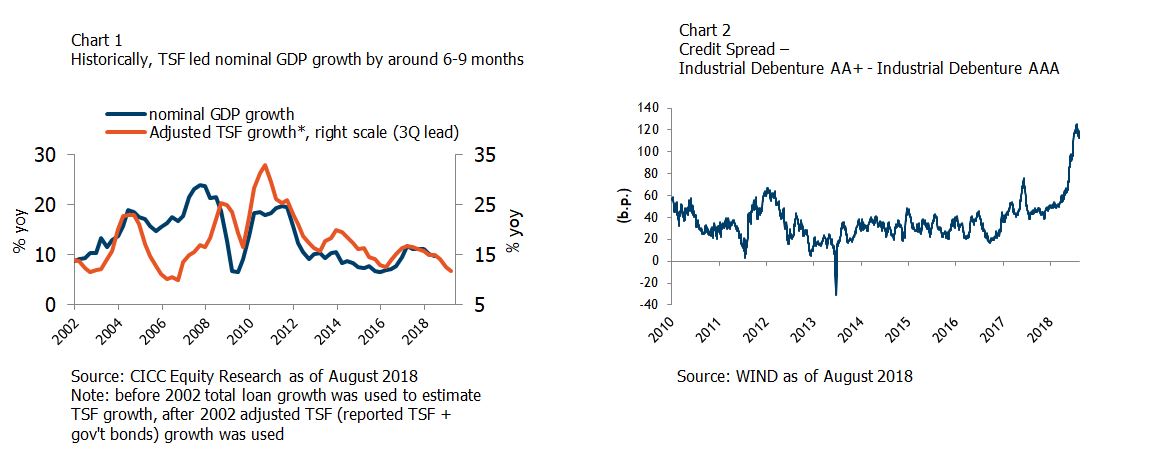

We are tracking two main goal posts to gauge whether the government is successful in its implementation; the first is Total Social Financing (TSF) which has been decelerating for almost a year. We would like to see TSF growth to stabilize or to pick up. Past observation tells us that TSF generally leads economic figures by around 6-9 months [See Chart 1], and the stock market bottoms earlier than the economy. Secondly, we are tracking China’s credit spread which is at credit crunch levels, and we would like to see it comes down meaningfully [See Chart 2]. We believe investment sentiment will significantly recover if positive signs emerge from these two indicators.

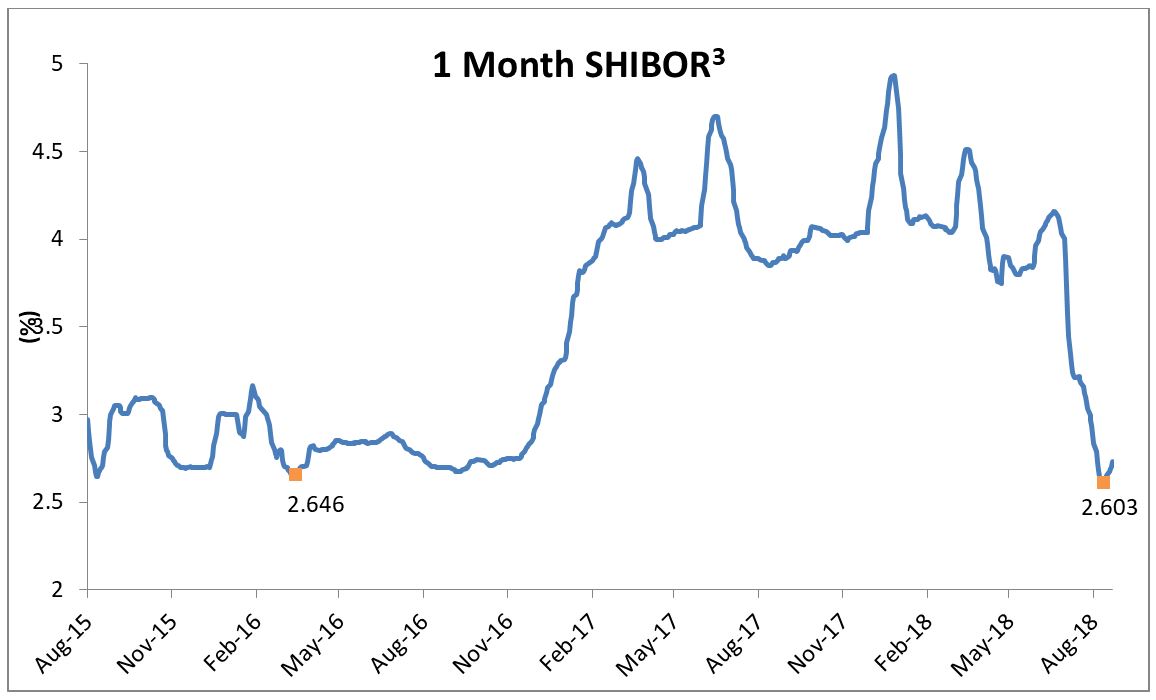

July TSF dropped to 1.04 trillion yuan, declining by 10.7% YoY1. But we’re encouraged to see sequential growth of adjusted TSF rebounded to 13.3% MoM annualized from 7.6% in June2. Furthermore, there are signs that the effects of government actions are starting to surface as the cost of money in China is eye-catchingly low recently. The 1 Month SHIBOR has recently moved down significantly to levels unseen since 20163. For smaller banks needing to sell negotiable certificates of deposit (NCDs), yields are near record-lows. Currency forwards, interbank borrowing costs, government bonds and interest-rate swaps show a similar picture. We believe the trend is likely to persist as China embarks on a 2009 US-like monetary easing together with credit tightening to deleverage the economy in an orderly fashion.

[1] Source: People’s Bank of China as of Aug 2018

[2] Source: CICC Research as of Aug 2018

[3] Source: Bloomberg as of Aug 2018

This document is based on management forecasts and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. In preparing this document, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources. All opinions or estimates contained in this document are entirely Zeal Asset Management Limited’s judgment as of the date of this document and are subject to change without notice.

Investments involve risks. You may lose part or all of your investment. You should not make an investment decision solely based on this information. If you have any queries, please contact your financial advisor and seek professional advice. This document is issued by Zeal Asset Management Limited and has not been reviewed by the Securities and Futures Commission in Hong Kong.