The value of China’s individual investable assets (including cash in bank accounts, but excluding property investments) reached RMB 133 trillion (US$20 trillion) in 2017 1. It is estimated that the total investible financial assets will grow to around RMB 175 trillion (US$26 trillion) by 2020, which would make China the second largest asset management market in the world1. Though the rich getting richer is admittedly a major driver of the total wealth growth, we see that the mass and mass affluent groups are playing an increasingly important role, making an impact on the future of China’s asset management industry.

How do Chinese people manage money?

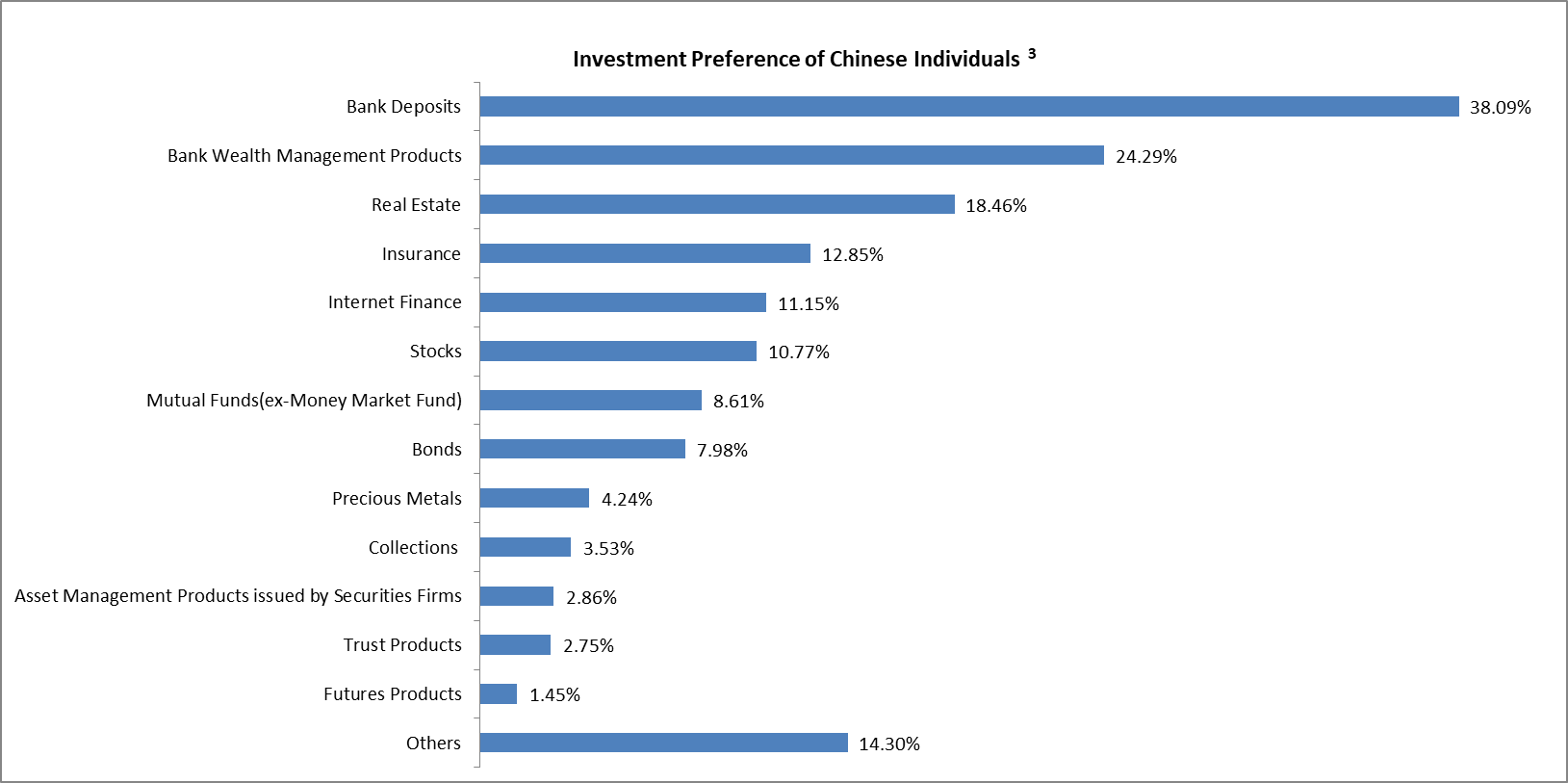

When it comes to money management, Chinese are historically more risk averse than their western counterparts and the country’s saving rate has been among the highest in the world, at 46% in 2016 versus the global average around 25% 2. According to a survey on money management habits conducted by Tencent Research Institute Chinese Academy of Social Sciences, 38.09% of respondents chose traditional bank deposits, including demand and term deposits, as their major investment vehicle3. The second most popular vehicle is bank wealth management products (24.29%), followed by real estate (18.46%), insurance (12.85%) and internet finance (11.15%)3.

What factors are affecting their money management habits?

Limited Discretionary Income – One of the main reasons people with steady paychecks haven’t started investing is limited discretionary income. The average monthly salary for white-collar workers is RMB7,850 (around USD1,162) in the third quarter of 2018 4, released by Zhaopin Limited, a leading career platform in China. According to the survey conducted by Tencent Research Institute and Chinese Academy of Social Sciences, after paying for taxes and necessary expenses, such as food, clothing, shelter, education, transportation and healthcare, 62% of surveyees have less than 20% of monthly income for saving, investing and other discretionary spending3. 37% of the surveyees who don’t manage their discretionary income think that they couldn’t generate significant income from investing since they don’t have much money left as principal after bills, so they don’t bother trying3.

Low level of Awareness about Investing – Besides 37% of the surveyees mentioned above who don’t bother trying to invest, 18% say they don’t have the habit of managing money and around 10% don’t want to take the risk of losing principal3. In 2018, there is reportedly RMB1.5 trillion idle cash including banknotes and coins, balance at third-party payment account, checking account balance, etc. that has not been put to work, this sum could have generated RMB57.32 billion income annually5. Nearly anyone can invest, whether she has $10 or $10,000. Starting with small amounts can make an impact on future wealth. There is obviously still lots of room for the masses to further develop awareness regarding investment.

Technology – Even though saving is a habit that’s deeply rooted in Chinese culture, the booming consumer credit in recent years indicates that the Chinese actually love to spend when they are confident about what the future holds and have better access to credit.

Borrowing money from a bank is not easy for average Chinese consumers, because 1) a large number of people who live in rural areas are financially underserved; 2) credit infrastructure is insufficient and over 60% of the Chinese population were “credit-invisible” in 20156; 3) banks are unlikely to lend to non-VIP clients without collaterals and they are categorized as an unprofitable customer segment. On the investment side, there are also many barriers that stop them from starting their investment journey, such as high threshold and low efficiency of banks, limited choices of suitable financial products, and lack of financial knowledge.

Fintech innovations have made financing and investing much easier for ordinary people. According to a study from accounting firm EY, 58% of Chinese consumers reported using fintech platforms for savings and investment, and 46% used fintech to borrow money7. Attracted by extremely low investment minimum, streamlined investment process, and a wide variety of investment products, beginner investors, especially the tech-savvy generation, turn to online investment management platforms as their first stop when they are ready to invest.

How does Zeal grow Chinese Presence by going Digital?

The year 2018 marks the 40th anniversary of China’s reform and opening-up. Many groundbreaking policies were rolled out last year, showing the country’s confidence and determination in further opening up various sectors. In April 2018, China’s regulator removed caps on foreign ownership in Chinese financial institutions, including banks and asset management firms, and promised to permit full control in three years, a major step forward for China to open up its financial services sector.

As a Hong Kong investment management firm founded in 2009, Zeal has been a trailblazer in China’s asset management industry and benefited from China’s opening-up initiatives in the financial sector. In December 2015, one of Zeal’s retail funds was approved by China Securities Regulatory Commission (CSRC) to be publicly distributed in mainland China, in the first batch of Hong Kong funds that received Mutual Recognition of Funds (MRF) status. The MRF scheme is a bilateral regulatory framework which allows mutual funds of Mainland and Hong Kong to be distributed to retail investors in each market.

Unlike competitors who started with traditional bank distribution, Zeal decided to first go online with Tianhong Asset Management, an affiliate of Alibaba Group’s mobile payment platform Ant Financial, and this strategy enabled us to hit the market first. Being the first has the advantage of having focused and wide coverage by the media, building our brand presence across the entire country. Also, the merits of online investment platform has made “inclusive finance” possible, which means all people of working age have access to a full suite of quality financial services, provided at affordable prices and in a convenient manner.

Easy access to investment –In order to fulfill the needs of individual Chinese retail investors, the minimum subscription amount was set at a low threshold of RMB10. This enabled almost universal access to our product. Zeal has established a customer base of over 270,000 just on one platform – Ant Financial8. Among the subscribers, 84% are post-80s and post-90s who are the rising middle class in China9, which means there’s a growing demand for asset management service.

Effective communication between investors and asset managers – through the public chatroom in the investing app, all investors can receive marketing materials and investment information from a specific asset manager or participate in group discussions regarding a specific fund. For investors, it’s easy for them to keep up with latest investment information and learn investment skills on the go. For asset managers like us, it enables us to check the pulse of investors, to know their sentiment, inquiry, and needs. As one of the very first MRF product providers in mainland market, Zeal has been helping Chinese retail investors develop and establish an awareness of investment diversification and oversea asset allocation through continuing investor education and marketing activities.

Better customer experience based on big data – with all the data collected from investor’s app usage history and personal information, the app creates detailed buyer personas, including investing habits and reading preferences, which are used for business analysis to produce tailored marketing campaigns, recommend relevant products, and improve customer experience.

[1] Source: PwC, as of Oct 2018

[2] Source: Bloomberg, as of July 2018

[3] Source: Tencent Research Institute & Chinese Academy of Social Sciences, as of Jan 2017; research by project team

[4] Source: Zhaopin Limited, as of Oct 2018

[5] Source: cnstock, as of Nov 2018

[6] Source: Oliver Wyman, as of Aug 2017

[7] Source: EY, as of June 2017

[8] Source: Tian Hong Asset Management Co. Ltd, as of Jan 2019

[9] Source: Tian Hong Asset Management Co. Ltd, as of Jan 2018

Disclaimer:

This document is based on management forecasts and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. In preparing this document, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources. All opinions or estimates contained in this document are entirely Zeal Asset Management Limited’s judgment as of the date of this document and are subject to change without notice.

Investments involve risks. You may lose part or all of your investment. You should not make an investment decision solely based on this information. If you have any queries, please contact your financial advisor and seek professional advice. This document is issued by Zeal Asset Management Limited and has not been reviewed by the Securities and Futures Commission in Hong Kong.