The environment in which the Federal Reserve is raising interest rates now is a world apart from where the two preceding tightening cycles were in. When the Fed hiked rates in the past, the stock market would typically rally because the central bank did so with the objective to pre-empt overheating risk in the economy, and to keep its powder dry for future needs to reduce rates, which suggested that the economy was sustaining a certain level of growth momentum. In today’s economy, however, the Fed has had to raise rates and shrink its balance sheet rapidly and aggressively, in the hope of making up for lost time because the central bank’s tightening cycle had lagged behind rising inflation significantly.

The recent market sell-off, however, raises the question of how much rate increases have been priced in. Before we answer this question, consider the following proprietary interest rate valuation model. Assuming that the terminal federal funds rate is settling at 3%, coinciding with a flattening yield curve, the model shows that the price-to-earnings ratio (P/E ratio) of the S&P 500 index will fall 24% from its peak of 24x to 18.3x, taking the index down to around 3600, 12% below round about 4100 as of June 6.

In another scenario in which we assume the terminal federal funds rate reaches a higher-than-estimated 4%, coinciding with an inverted yield curve, the fair P/E ratio of the S&P 500 index will drop further to 16.5x, bringing it down to around 3250, just two-thirds of its peak value.

Our calculations currently assume that its earnings per share remain unchanged, but one can certainly expect a bigger drop in the S&P 500 index than our estimates above in an economic downturn as corporate earnings will also fall.

Another question is: How is the US economy performing at the moment? Will it hold up under the pressure of rate hikes?

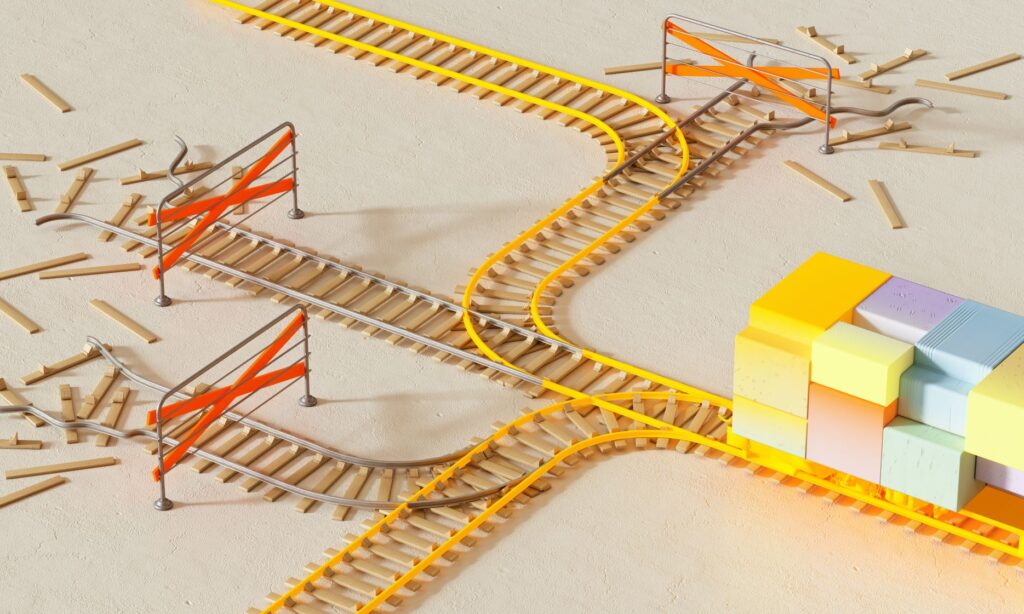

An inverted yield curve has historically been one of the most accurate indicators of the US economic outlook, but one should be mindful of the specific tenor of the US Treasury notes with which investors use to calculate the yield curve. Typically, most would look at the differences on yields between the 10-year US Treasury note versus that on the 2-year or 3-month notes. The 2-year/10-year spread and the 3-month/10-year spread have been largely in sync in the past seven years, until Q4 last year, when they started to go separate ways: The former predicted a looming US recession in the near future, but the latter said otherwise.

According to a research report published in early May by the Federal Reserve Bank of San Francisco, both conceptual and empirical arguments suggest that the 3-month/10-year spread proves to be more accurate in foretelling where the US economy is heading than the 2-year/10-year spread. As of now, there is still some way off before the former becomes inverted, so the possibility of the US economy entering a recession over the short term should be modest.

Both the Conference Board Leading Economic Index and Purchasing Managers’ Index – another two gauges – have also shown similar results, pointing to moderate growth in the US economy over the short term. But if inflation does become unbridled, thus forcing the Fed to raise rates continuously, chances are the economy may struggle to remain stable.

Disclaimer

This document is based on management forecasts and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. In preparing this document, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources. All opinions or estimates contained in this document are entirely Zeal Asset Management Limited’s judgment as of the date of this document and are subject to change without notice.

Investments involve risks. Past performance is not indicative of future performance. You may lose part or all of your investment. You should not make an investment decision solely based on this information. Each Fund may have different underlying investments and be exposed to a number of different risk, prior to investing, please read the offering documents of the respective funds for details, including risk factors. If you have any queries, please contact your financial advisor and seek professional advice. This material is issued by Zeal Asset Management Limited and has not been reviewed by the Securities and Futures Commission in Hong Kong.

There can be no assurance that any estimates of future performance of any industry, security or security class discussed in this presentation can be achieved. The portfolio may or may not have current investments in the industry, security or security class discussed. Any reference or inference to a specific industry or company listed herein does not constitute a recommendation to buy, sell, or hold securities of such industry or company. Please be advised that any estimates of future performance of any industry, security or security class discussed are subject to change at any time and are current as of the date of this presentation only. Targets are objectives only and should not be construed as providing any assurance or guarantee as to the results that may be realized in the future from investments in any industry, asset or asset class described herein.