Just as emperor penguins huddle together for warmth during cold weathers in Antarctica, investor communities tend to invest in similar themes to make up for the lack of confidence during harsh conditions. Amid uncertainty in the Chinese onshore and offshore markets, we noticed that investors are inclined to buy relatively macro-insensitive stocks that are perceived by them to have high degrees of certainty, such as food and beverage and other consumer staples. For example, one of food seasoning manufacturers was up almost +60% YTD and one of hot pot restaurants soared more than +100% YTD1. We understand the rationale of this behavior. However, are these food stocks really a defensive play at this juncture?

. . .

Chinese people spent 4.27 trillion yuan (USD 597 billion) on dining out in 20182, which is even higher than Sweden’s GDP (USD 551 billion3) and one type of cuisine dominates China’s restaurant industry – hotpot, eating almost 14% of the total market share1. With consumer sentiment weakening amid a sluggish economy, investors have been loading up on their perceived safe stocks, including the above-mentioned hotpot stock, as an old Chinese saying goes “Eating means the world to people” and they believe the company’s aggressive store expansion will increase revenue significantly.

In 1H19, the hotpot chain generated 11.7 billion yuan in revenue, up 59.3% from a year earlier4. Nevertheless, the company’s valuation, in our view, has been pushed to an expensive level, which could lead to the risk of a collective sell-off once risk appetite returns.

We think the current stock price has already baked in the scenario of rapid earnings growth in next three years, which may not turn out as the market expects. The current high valuation is based on the market’s hope that the chain will constantly break the ceiling on the number of restaurants locations and per store profitability maintains momentum. Notwithstanding, from its interim results for the first half of 2019, average income for single store slipped -8.89% YoY4 and table turns for restaurants in Tier 1 cities declined from 4.9X in 1H18 to 4.8X in 1H194, indicating that new stores may cannibalize sales of existing stores. The stock is trading on a 12-month forward P/E ratio of 54.2x at the time of writing, an increase of 81% YTD, while its peers have much lower forward P/E ratios of 23.5x and 16.1x1.

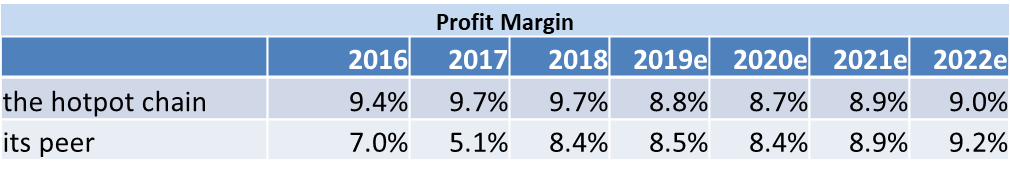

In addition, some of its peers’ profit margin is catching up with this hot stock (see chart below5), with the valuation remaining at a reasonable level.

Despite that the hotpot chain’s strong brand and execution will support its earnings growth, we don’t think it provides a decent margin of safety.

. . .

With the fear of missing out on a market rally, some investors may forget about disciplines and rush into an expensive investment. Instead of crowding to this space, we tend to focus more on companies that become undervalued during this round of market volatility. Although they might be perceived as more risky than defensive stocks at this moment, we believe that accumulating them at attractive valuations will drive medium to long term returns when the dust settles.

[1] Source: Bloomberg, as of August 2019

[2] Source: People.cn, as of July 2019

[3] Source: World Development Indicators database, World Bank, as of July 2019

[4] Source: Company Interim Report 2019, as of June 2019

[5] Source: Zeal Asset Management Limited, as of July 2019

Disclaimer

This document is based on management forecasts and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. In preparing this document, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources. All opinions or estimates contained in this document are entirely Zeal Asset Management Limited’s judgment as of the date of this document and are subject to change without notice.

Investments involve risks. Past performance is not indicative of future performance. You may lose part or all of your investment. You should not make an investment decision solely based on this information. Each Fund may have different underlying investments and be exposed to a number of different risk, prior to investing, please read the offering documents of the respective funds for details, including risk factors. If you have any queries, please contact your financial advisor and seek professional advice. This material is issued by Zeal Asset Management Limited and has not been reviewed by the Securities and Futures Commission in Hong Kong.

There can be no assurance that any estimates of future performance of any industry, security or security class discussed in this presentation can be achieved. The portfolio may or may not have current investments in the industry, security or security class discussed. Any reference or inference to a specific industry or company listed herein does not constitute a recommendation to buy, sell, or hold securities of such industry or company. Please be advised that any estimates of future performance of any industry, security or security class discussed are subject to change at any time and are current as of the date of this presentation only. Targets are objectives only and should not be construed as providing any assurance or guarantee as to the results that may be realized in the future from investments in any industry, asset or asset class described herein.