The uncertainties lingering around the Sino-US trade relations intensified in a notable way when the Trump Administration has released the 25% tariff 10against a total of USD50bn of imports from China (separated into 2 tranches: USD34bn to be effective on 6 July and USD16bn to be effective after public comment process)1. China retaliated within hours in a tit-for-tat manner. China has also stated that the understanding reached in the visit by Ross Wilbur in the earlier part of the month has been nullified. These developments have been generally considered as a very big step on both sides in getting closer to a full-fledged trade war.

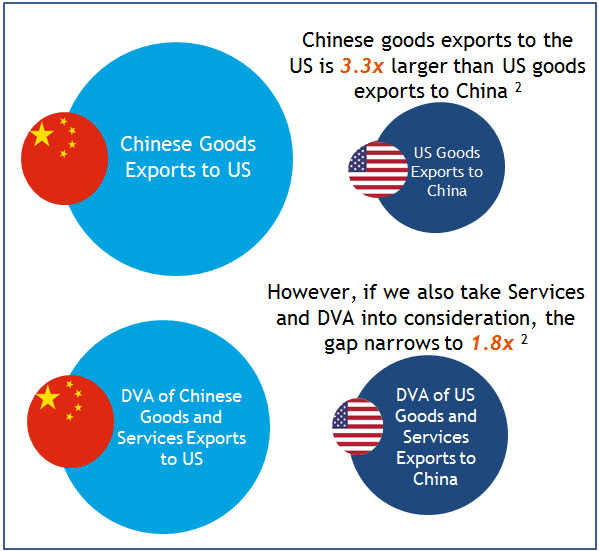

The markets nose-dived on 19th June when they re-opened after the Dragon-Boat festival long weekend. We understand the risk-averse mentality of investors under such a macro backdrop. However, our view remains that the US business community will soon feel the pain of China’s retaliation and the swing in their stance might have a profound implication on the policy stance of the Trump Administration. The underlying rationale of ours is that the economic repercussions from the trade war do not skew disproportionally to China in any major way. This is in contrary to the conclusion that one might arrive at if one only considers that Chinese goods exports to the US is 3.3x larger than US goods exports to China. This narrow focus on merchandise trade overlooks risks of higher prices for consumers, to services trade, to value added spillovers, and China’s ability to retaliate through non-tariff/trade policies. In fact, the 3.3x gap narrows by about 60% once the US’s larger services exports and much larger domestic value added (DVA) of US exports to China (85% vs 66% for China DVA of exports to US) are factored in2.

China is still more exposed than US on trade if all these adjustments are taken into the equation, but the gap is not as wide as merchandise trade data would have superficially suggested. On the topic of risk of higher prices for US consumers, we are already beginning to see signs of this. Since January 2018, the US has a 20% tariff on imported washing machines, and laundry equipment under the US Bureau of Labor’s CPI has jumped 17% in the last 3 months, which is the largest price increase over a 3 month period in the last 12 years3.

The US public opinion on tariffs may shift drastically if more durable and non-durable consumer items experience a similar phenomenon. We maintain our view that these actions from the US are more likely to be intimidating gestures rather than effective tools to force China to comply with the rules that the US prefers.

As pointed out by various economists in the market, if these proposed tariffs are all imposed, the impact on the Chinese GDP would be no more than 0.4% points, even assuming the USD50bn Chinese exports to the US would simply evaporate (assuming 100% of the value-added of these exports is originated in China)1. In reality, this wouldn’t be the case. We think that a 10-25% reduction of trade volume is more likely to happen; hence the actual impact on China’s GDP would be 0.04% to 0.1%. Even if the other USD16bn China exports would be subject to same tariffs, the actual impact might be less than 0.15%, which we think is manageable given the fiscal and monetary leeway that the Chinese government currently possesses.

What happens between the two major economic powers over the next few weeks would be crucial. We shall keep close monitoring on this front and will update our readers here.

[1] Source: CICC Research as of June 2018

[2] Source: Citi Research as of June 2018

[3] Source: Ming Pao Finance as of June 2018

This document is based on management forecasts and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. In preparing this document, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources. All opinions or estimates contained in this document are entirely Zeal Asset Management Limited’s judgment as of the date of this document and are subject to change without notice.

Investments involve risks. You may lose part or all of your investment. You should not make an investment decision solely based on this information. If you have any queries, please contact your financial advisor and seek professional advice. This document is issued by Zeal Asset Management Limited and has not been reviewed by the Securities and Futures Commission in Hong Kong.