Though onshore and offshore China markets sank on trade uncertainty in May again, we saw two silver linings this year. First, domestic monetary condition improved meaningfully on the back of a series of easing measures to inject liquidity since 4Q18. Second, we expect market sentiment to be less bearish than last year. For much of 2018, markets were still worried about whether the government would implement any stimulus, and even if they do, the efficacy of the stimulus. And in 2019, the first quarter’s high frequency data largely beat market expectation, giving market participants confidence in China’s ability and determination to stabilize growth.

Why Economic Data Softened in May?

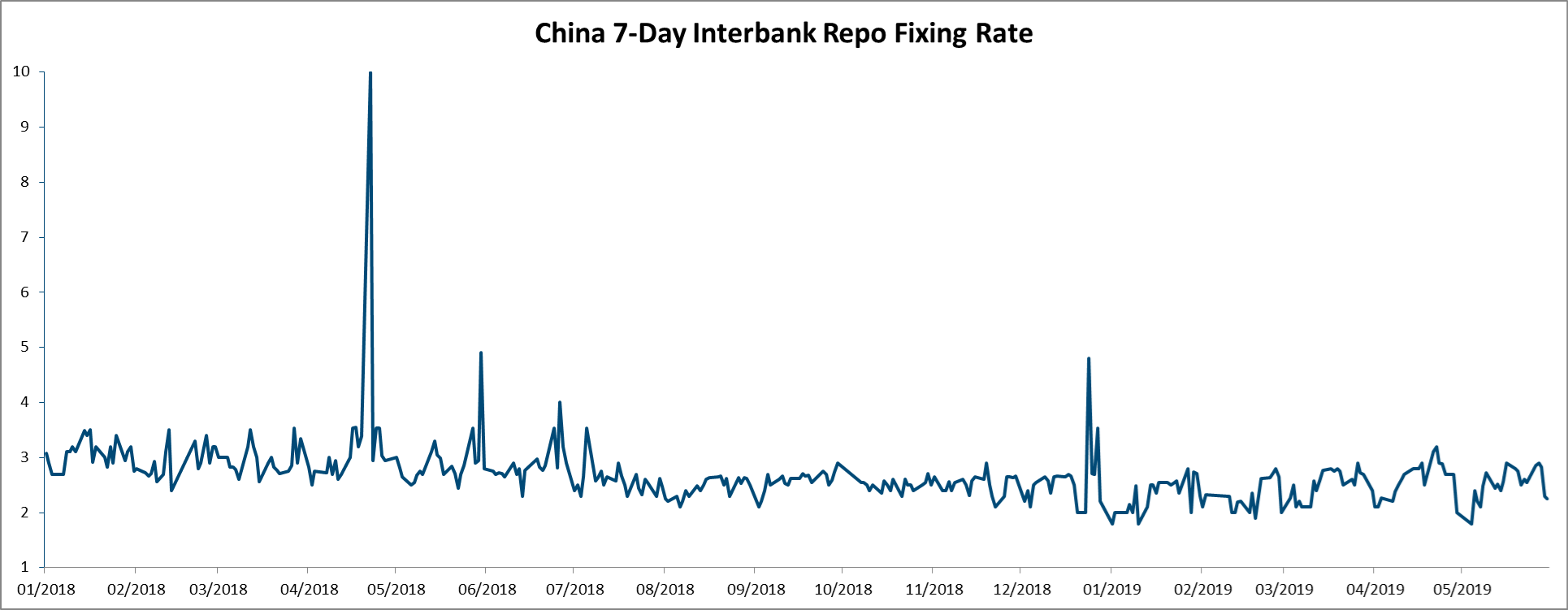

Even so, we need to understand thoroughly as to why the economy seems to have weakened again in April and May. Naturally, the re-surfaced trade tension was one of the reasons behind the softening. However, we think that the Government is indeed very conscientious of not turning this supportive stance into a massive stimulus program. A very clear signal has been sent through its management of the systematic liquidity, as evidenced by the movement of the 7-days Repo rates (RP07) of the inter-bank market (see chart1).

Source: Bloomberg, as of May 2019

Since mid-2018, the Government has been loosening its monetary stance, hence RP07 has been trending down from around 3% to a tad below 2% in 1Q191. On the back of the apparent stabilized performance of the economy, the Government clearly did not want to incrementally provide the economy with excessive liquidity, and the Repo rate rebounded moderately since mid-March. We endorse such a prudent policy approach as we concur that targeted easing and focus on effectiveness of the measures (such as tax cuts and more productive infrastructure investments) are far better means to safeguard the economy than a “shot-gun approach”.

We take the view that the measures announced/implemented so far should be good enough to arrest the downside of the economy, should the trade tension not be re-ignited. We are very convinced that the impact from the renewed trade tension in recent week is, similar to the situation in the US, more on sentiment and business confidence in capex and longer-term planning. Since the US seems to have secured a “Fed put” on a weak economy due to the trade war, we think that a loosened US monetary stance is very likely to provide more room for the People’s Bank of China to effect an equally accommodating policy since the pressure on China capital account should ease.

More Counter-cyclical Measures In The Toolkit

If the 25% tariff on USD 200bn remains in place for a few months, the estimated direct impact on China’s growth via trade and supply chain is estimated at around 0.5% of GDP2. We think China has more counter-cyclical measures, e.g. accelerated and better-targeted credit growth and augmented fiscal deficit, to offset the impact of tariffs. The latest policy of relaxing the use of proceeds from Specialized Local Government Bonds for initial equity investments in Fixed Asset Investment projects is in-line with this board policy approach, which would de-bottle-neck some of the structural barriers in the credit creation process. If trade escalation persists in the future, China still has some room for further reserve requirement ratio cuts and will likely roll out pro-consumption measures.

[1] Source: Bloomberg, as of May 2019

[2] Source: Morgan Stanley, as of May 2019

Disclaimer

This document is based on management forecasts and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. In preparing this document, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources. All opinions or estimates contained in this document are entirely Zeal Asset Management Limited’s judgment as of the date of this document and are subject to change without notice.

Investments involve risks. Past performance is not indicative of future performance. You may lose part or all of your investment. You should not make an investment decision solely based on this information. Each Fund may have different underlying investments and be exposed to a number of different risk, prior to investing, please read the offering documents of the respective funds for details, including risk factors. If you have any queries, please contact your financial advisor and seek professional advice. This material is issued by Zeal Asset Management Limited and has not been reviewed by the Securities and Futures Commission in Hong Kong.